Selling Mortgage Insurance Using Mortgage Protection Leads

Interested in selling mortgage insurance with mortgage protection leads?

- What it takes to be successful at selling mortgage insurance

- The personality of the closer

- Mortgage protection vs final expense sales

- Fully underwritten vs simplified issue

- Selling mortgage insurance with the right carriers

- Aged vs fresh mortgage protection leads

- Unethical IMO’s and what to beware of

- Fair commission levels and lead costs

- Free mortgage protection leads programs

- The value of selling mortgage insurance

Selling mortgage insurance can be very lucrative if you are talented, and have a good flow of mortgage protection leads. The key is to have the right personality along with a strong work ethic. I firmly believe that you must have a true sales person mentality and personality. If you can accept that life insurance sales is a grind right from the start, you’ll be better off. The reason I say this is because 80% of all newly licensed life insurance agents, are out of the industry within 12 months. Seriously, life insurance sales is not for everyone. With most agents, the problem isn’t that they lack decent mortgage protection leads. The problem is that big space between their ears. It doesn’t matter if you’re selling mortgage protection face to face, or even if you’re doing final expense telesales, you must also be a closer.

Are you selling mortgage insurance or final expense?

When it comes to final expense sales, the people are easier to deal with and easier to sell to. The senior market has always been this way and that’s why some states have very strict laws regarding senior citizens. Sadly enough, our seniors tend to be an easy prey for unethical insurance agents and sales people. If you’re selling mortgage protection insurance, you’re dealing with a much more sophisticated crowd. These are mainly professionals who have their act together enough to have a mortgage. These folks are a lot harder to sell to as they can tell if you’re new and unsure of yourself, or if you’re a seasoned life insurance agent. They’re great at getting rid of sales people, even if they filled out the mortgage protection leads cards. You must be a talented closer, to be successful at selling mortgage insurance.

Having a strong work ethic is important for life insurance sales. Especially if you’re selling mortgage insurance or final expense life insurance! Most people just have a hard time adjusting to the long hours and are not good at rejection. You will likely hear a lot of no’s before you can get to a yes, especially if you’re new at selling mortgage insurance. Remember, mortgage protection leads are just that, leads! A lead is simply an excuse to get in front of someone and make a presentation. Therefore, most insurance agents blame the leads for their failure. They don’t want to accept that they could have spent more time on their presentation. In most cases, they simply didn’t try very hard. Without the work ethic, you won’t be successful at selling mortgage protection, final expense, or any life insurance products hence this may not be for you.

Mortgage protection leads and the typical insurance agent

It takes talent and a strong personality, and a whole lot more. Without the right personality, you don’t have a chance. It doesn’t matter if you’re making final expense telesales or selling MP. As often as it seems to be the quality of the mortgage protection leads, it’s almost always the life insurance agent. When I first was recruited and got into selling mortgage insurance, it was hard. I did it for a few months and quit. At that point, I was already successful at selling home improvement products. The market got tough and it just made sense to get into mortgage protection sales. I just didn’t realize how ward it would be, until I realized how hard it was. So, I went back to home improvements! The money just wasn’t what it used to be therefore, I started to realize that I needed to change.

I knew I would make a better living selling mortgage protection. I just needed to accept that it would be harder work than what I was used to! Once I accepted this, I went back to selling mortgage protection insurance. Ended up at a different IMO but felt mislead by them! I stuck it out for a few months and ended up back at the agency that originally recruited me. I was their number one agent, my first month back, and was their top guy until I left. This was because I had accepted that I needed to change my work ethic to be successful. I was also desperate, financially. There is nothing like hitting a financial bottom, to help you change. FYI, I only left that agency because they lost the product and mortgage protection leads program.

Selling mortgage insurance with the right IMO

Not all IMO’s are equal. Most of them start their agents at truly low commission levels. Like I said, selling mortgage insurance isn’t easy. Since most agents fail, the agencies are not willing to take the risk on newer agents, by giving them normal, 100% commission levels. That’s understandable but here’s the problem. Once the newer agent succeeds, the insurance agency doesn’t give them an increase in commission. If they do give them an increase, it’s not enough to make a difference. That life insurance agent will never see 100%. The agencies justify this due to the cost of the mortgage protection leads and failure rates. The training is often a factor too! You see, it costs money and takes time to train a new agent. Unfortunately, most of these mortgage protection agencies don’t even have good training.

Beware of the “warning” signs. To me, it makes no sense for an agency to have their new agents recruit their friends and family. Why would you want to bring your loved ones into a business that you don’t even know? Yes, the old MLM pyramid scheme is alive in the final expense and mortgage protection industries. In most cases, selling mortgage insurance isn’t enough for these insurance marketing organizations. They want you to recruit. Even if you have no clue about working mortgage protection leads! I don’t know about you, but the last thing I would do is follow someone into a sales business, when they don’t even know how to sell. This is the type of organization that I want to avoid. If you get good at selling mortgage insurance, final expense, or doing final expense telesales, then recruit.

The best product for each prospect

There are several products for selling mortgage insurance. This is where it gets a little complicated for new agents. You have your choice of simplified issue and fully underwritten. You also have term life insurance and universal life. Both can be written to cover a mortgage but are very unique in the way they build cash value. They also can vary in the longevity of the policy. In most cases universal life insurance is a temporary policy, just like term life. A good mortgage protection leads program will get you in front of people that are curious about these products. It’s up to you to give the right product to the right prospect. Everyone has different needs and we all have different income levels. A talented life insurance agent can put the right prospect with the right product. This goes for final expense and final expense telesales too!

Simplified issue usually means that there is no blood drawn from the prospect, and no examination done. The underwriter simply pulls a prescription check and does a MIB background check. In most cases, they will also request medical records from the primary doctor. Fully underwritten usually means the full boat. A paramedic exam will take place. Blood and urine will be collected. Doctor records will be pulled. That’s why you won’t catch me selling mortgage insurance or working mortgage protection leads. Been there, done that! I would rather sell final expense. The appointments are during the daytime and the people are easier to sell. My favorite FE carrier, Security National Life, only pulls a medication prescription check. It doesn’t get easier than that.

Mortgage protection leads costs and commission levels

Commission levels and lead costs will vary with all insurance marketing organizations. If you’re selling mortgage insurance as an independent agent your first-year commissions for most of the term and UL products are going to be around 90-100%. Direct mail, mortgage protection insurance leads will cost you around $53 each. Yes, mortgage protection leads are expensive. Here is something to beware of. Most of the mortgage protection and final expense IMO’s will exaggerate their commission levels while they’re recruiting you. They’ll make the commission levels an insignificant issue, while telling you that commission levels are going to be at 70-80% with most carriers. When you see your commission schedule, the primary Term product you sell, will likely pay around 20 points less than the final expense product. In many cases, you’ll find out that your most competitive products with these IMO’s are only paying you around 50% first year commissions.

With most final expense and mortgage protection agencies, you will be offered leads at half the cost, around $20-$25 each. Unfortunately, most of those leads will probably be re-worked leads. At least in the beginning! The IMO’s will want you to prove that you can sell mortgage insurance, before they give you the better, fresher, never worked, final expense or mortgage protection leads. The last thing anyone wants to do is pay for part of your leads. Then realize that you are not prepared, or simply don’t have the work ethic for life insurance sales! I’m hoping this makes sense to you. If not just ask yourself this. Are you willing to hand over your money to an unproven insurance agent? Of course not. Me neither. Remember what I mentioned earlier about most agents failing and not having the work ethic necessary for success!

Selling mortgage insurance with so called “Free Leads”

There is no such thing as free leads. There are plenty of agencies that offer their “free” mortgage protection leads programs or free final expense leads. The commission levels will likely be lower than the ones mentioned above. As far as I’m concerned, these IMO’s are the worse, and in most cases, you should avoid them. The only difference will likely be that the leads have been previously worked by several agents. You will really have to prove yourself, before you receive any new or un-worked leads. This will be even harder due to the age of the leads, and depending on how many agents already worked them. Selling mortgage insurance or final expense with free leads, usually ends up costing you more than its worth. Therefore, free leads are usually the most expensive leads!

If you’re going to sell Mortgage Protection, it’s important to have the best and most competitive products. Here is a list of my favorite carriers that have great Term, UL, Return of Premium, Fully and Simplified Underwritten Products.

American Amicable

Americo

Assurity

Baltimore Life

Cincinnati Life

Foresters

Mutual of Omaha

Protective Life

Prudential

Transamerica

United Home Life

As mentioned before, mortgage protection is a tougher sale than final expense because the MP market is mainly professionals or retired professionals. They’re just tougher to sale as they usually have better common sense than the final expense market. They often always want to think things through. They’re usually not willing to hand a check over to someone who doesn’t come off as being extremely professional. It doesn’t matter if you have the best mortgage protection leads in the industry, they are still going to be tougher to sell than final expense. Here is my list of why I only target the final expense market and rarely get into selling mortgage insurance.

Set the appointments and make the presentation

First, you want to purchase your mortgage protection leads. The best lead for this type of sale is always going to be direct mail. Once you have the leads, you need to call them and set up an appointment. If you are with an IMO that specializes in this market, you should already have a script and training on how to utilize it. The one thing about setting appointments is that it’s super easy to do it wrong and blow opportunities for presentation. Remember, the more appointments you make, the more presentations you make. The more presentations you make, the more sales you make. Common sense, right? Utilize your training and make sure you are doing everything that your manager teaches, to correctly set those appointments for selling mortgage insurance.

Once you’ve got the appointment, it’s time to go and sell something. One of the things that I learned while selling mortgage protection, is that people will get buyers remorse before they even meet you. This is when they call to cancel the appointment. I was taught not to pick up the phone or return the call. Just go make the presentation. There were times when I drove an hour to the appointment and they were not home. There were also times when I got there and they let me in after cancelling. Then I closed the sale! Go the extra mile. Agents that look for reasons to make presentations, make more sales. Your success starts between your ears. Don’t listen to your own nonsense. Your mortgage protection leads are not going to close themselves.

Here’s my mortgage protection leads appointment setting script

Hello, is this (customers name)? This is _____, how are you today?

Great, the reason for my call is because you had mailed in a request for information about protecting your mortgage, in the event of a death or disability, and I’m calling to verify the information that you gave us.

You have your Date of Birth as _______ and your HT/WT as ____ it also says you’re a (smoker or nonsmoker) is that correct? verify same info on spouse if needed…

Ok, and it shows your loan amount is ($). . . is that accurate?. . . Ok, no problem!

My office is in the _______ area, and I’m going to be dispatched to your area on (_day_) and needed set up a time I can stop by and drop off the information to you… it only takes about 15-20 minutes.

What time do you usually get home from work? (make appointments within 2-3 days if possible). ***Answer to I’m busy: I know I feel the same way…. Alright, I have an opening in my schedule on (day of week) at (time).

*tip give a window of time instead of a set time in case you run a little late (like a 30minute window)*

After you set appt. “If your anything like me I tend to forget things, so if you could write it down for me…my name is ____________ and I’ll be stopping by (day and time).

Are there any guard gates or dogs I need to deal with when I get there?

It’s been nice speaking with you and I look forward to meeting with you “day” at “time”.

Why I prefer final expense over mortgage insurance sales

1. Final expense sales mainly occur during the daytime while mortgage protection sales are made at night when the prospects get home from work.

2. Most of the mortgage protection leads these days are from people over 50 years old and are harder to get approved for term life insurance.

3. Mortgage protection leads are usually around $50 each while final expense leads are around $30 each.

4. Final expense direct mail leads are a lot more plentiful than direct mail mortgage protection leads.

5. With final expense you can use telemarketing leads and Facebook leads. These leads don’t really work for mortgage protection.

6. The underwriting is a lot easier and quicker with final expense than it is for selling mortgage protection.

7. Mortgage protection often requires blood and urine to be drawn along with doctor records to be pulled as with final expense, you can find out if the client is approved before leaving their house.

8. You can literally go door to door and sell final expense. Selling mortgage protection in this manner is pretty much a waste of time.

9. Mortgage protection presentation are often done on Sundays as that’s the only day the prospects are available. I’ve never had to make a final expense presentation on a Sunday.

10. If I want to travel next week, I can easily get final expense telemarketing leads or Facebook leads in that area. Try getting mortgage protection leads that quick!

11. Final expense telesales is easier than MP telesales, although you can sell term life over the phone as a general product.

12. Renewals – Yes, the renewals for final expense can be 5-10% with whole life as are likely getting no renewals while selling mortgage insurance.

The Happy Ending

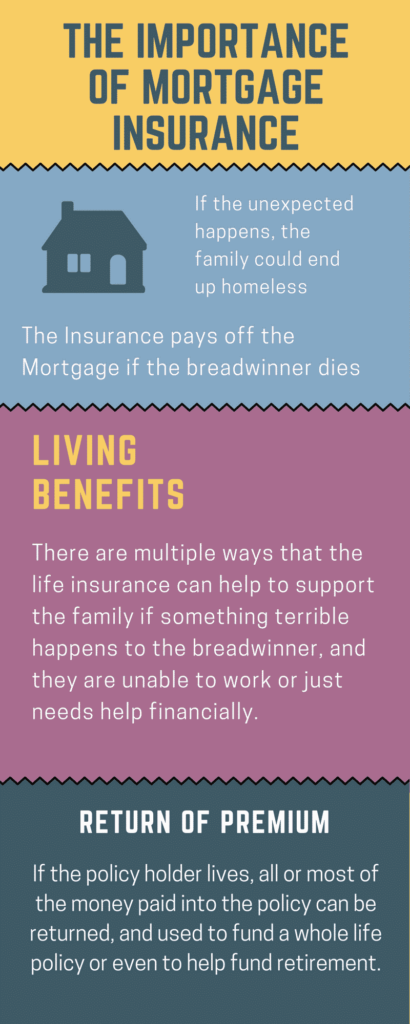

The last thing that we want to do is end this article about selling mortgage insurance, on a negative note. There are some strong points for targeting people with mortgages while using mortgage protection leads. You see, mortgage insurance sales has been around since the 80’s and will be here for a very long time. Intelligent people understand the need for this type of insurance. If they bread winner dies, the remaining family loses everything. With mortgage protection insurance, the family has a chance of survival. In many cases the insurance will do a lot more than pay off the mortgage. It can also fund the families survival for years. The insurance money can also put the children through college. This is why a good mortgage protection leads program is so important.

There are a ton of additional benefits involved with this type of insurance. Mortgage insurance sales also helps to fund retirement. Universal life insurance builds cash value. I have a policy that is designed to give me a monthly payment once I hit 65 years old. It may not be enough to fund my entire retirement, but it will make a nice addition. So while my family is protected in the event of my demise, when I survive, the funds from the policy will be returned to me, possibly double the amount of money that is being paid into the policy. Here is a list of benefits that comes from mortgage protection insurance that don’t involve the death of the insured. This is why there is a huge popularity of mortgage insurance sales, that are made with mortgage protection leads.

1. Living benefits. There are a lot of products available that the prospect can take advantage of while they are still alive. Here are some!

A. Disability Premium rider – If the client becomes disabled, they don’t have to pay for the insurance any more.

B. Unemployment rider – The insurance company sends a monthly payment to the owner of the policy for a certain amount of time if they become unemployed under specific situations.

C. Terminal Illness rider – Pays a percentage of the face amount to the policy owner if they are diagnosed with a terminal illness and have a life expectancy of 1-2 years or less.

D. Chronic Illness rider – Pays a percentage of the face amount to the policy owner if they are unable to perform a certain amount of ADL’s.

E. Critical Illness rider – Pays a percentage of the face amount that can be used to pay for medical bills if policy owner has a stroke, heart attack, or specific illness.

2. Younger prospects can often get a Return of Premium rider. This rider allows the policy owner to get their money or most of their money back when they live out the term of the insurance. This money can be issued as a lump sum or often as a monthly payment.

3. Persistency and placement are much better while selling mortgage insurance policies than with final expense. In most cases, these people are responsibility and once the policy has been delivered, you’ll rarely do any type of service work.

4. Direct mail mortgage protection leads – There is nothing stronger than when someone writes their information down on a card and mails in a request for information about mortgage insurance. This is the hands down, the best lead and way for selling mortgage insurance.

5. The face amount is usually huge. When the prospect dies, the family often gets enough money to pay off the house and survive.